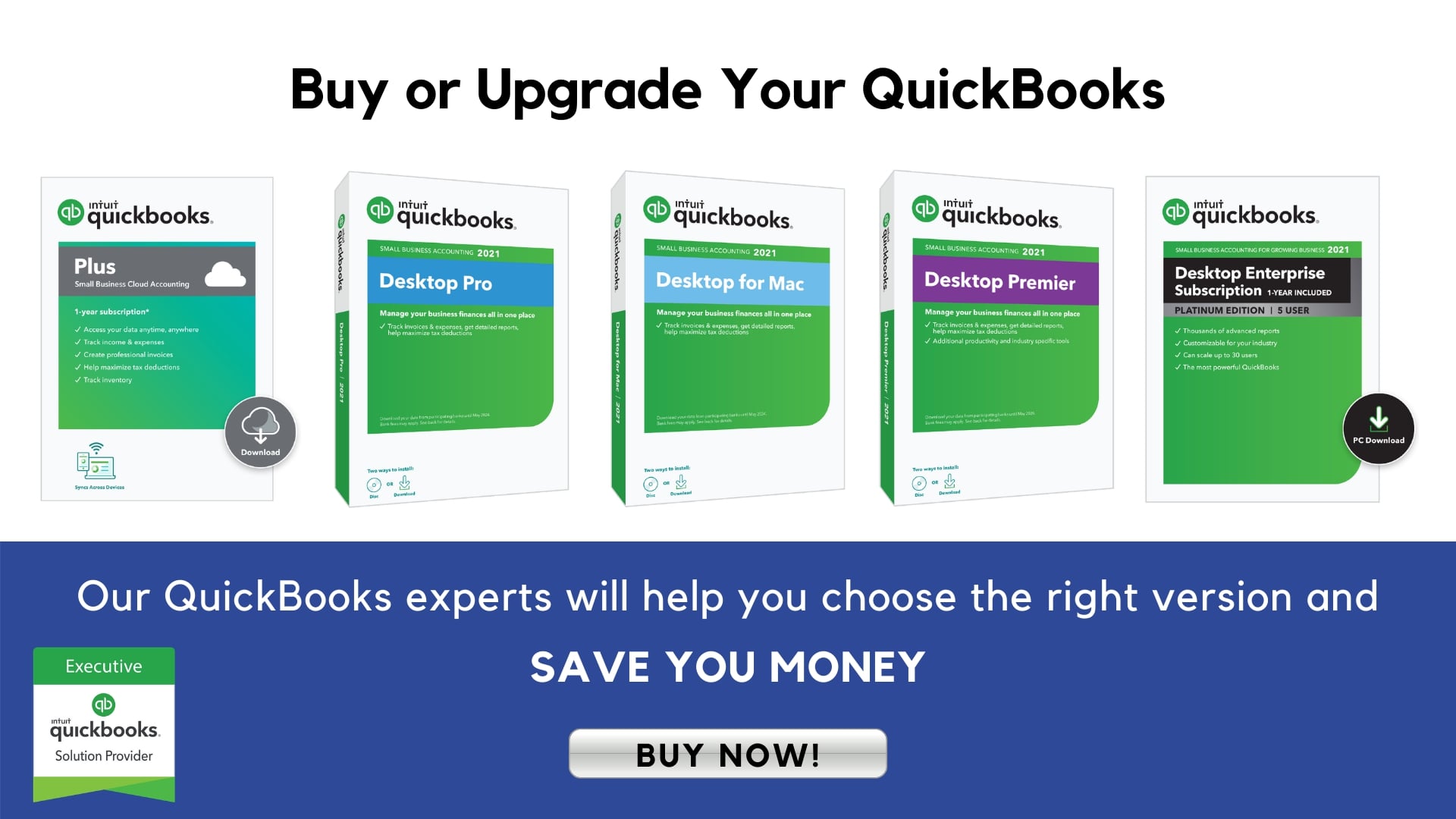

Currace Provides all kind of Quickbooks support service which is like Quickbooks online support, Quickbooks self-employed support, Quickbooks payroll support, Quickbooks desktop support, Quickbooks online accountant as well as help users in managing their business with many other Quickbooks tools. So it doesn’t matter what type of Quickbooks help you require and what kind of support you need for your business, you will get it all in one place.

So for any kind of technical or nontechnical QuickBooks customer support service make a call on Quickbooks error support number +1-855-999-0211, with this phone number you will get the best advice and suggestions for all kinds of technical or nontechnical Quickbooks error codes or technical issues.

To know about all services provided by certified experts of Quickbooks professionals, read this complete post, in this post, we cover all the services that we provide, to get all type of QB support call us or send a call back request.

our

Certificate of Completion

Contact Certified Quickbooks Expert

Get Complet Support for Quickbooks

Integration

Get Complete support for integration and integrate 3rd party software Woocommerce, Salesforce, Stripe, Squarespace, Amazon, paypall, Shopify or run your business with third party software & apps that work smoothely with Quickbooks.

Accounting & Bookkeeping

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Inventory Management

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Payroll & Payment Management

To save your time, earn more money and see happy faces of employee, manage your payroll or payments easily with our consultant. Our experts will hep you in managing direct deposit,automating payments, avoid penalty.

Get Complete Support for Quickbooks

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Why get Quickbooks support With Currace?

- To get 100% focused support: Currace provides focused accounting support service.

- Anytime any where accessibility: Users can contact Currace anytime from any where.

- Best Advice: Users can contact Currace for best advice and talk with expert.

- To know right way of accounting: Users can hire Currace to know the Right way of accounting.

- Get right solution at right time: Users can contact Currace to get right solution at right time without any delay.

- To manage payments or transaction: Users can contact QB experts for management of payments or transactions issues.

- To fix inventory management issues: With the help of currace you can easily fix inventry management issues or probllems.

- To keep your self updated: Currace will help you to keep your self updated with all trending information & updates

- For instant solution of Quickbooks error codes

If you carefully read all the above discussed information and now want to get support for Quickbooks and looking for a best possible way to contact Currace or customer service team of Currace. then you can try Quickbooks error support number +1-855-999-0211, contact form or chat box. With all these methods you can direcyty talk with world class accounting profestionals who provides customer service for Quickboks(QB) or all products related to it. Our executives or technical experts provides support for Quickbooks desktop, online, payroll, Quickbooks Pro, QuickBooks Premier as well as for lot of tools like QBFD, Quickbooks database server manager or more.

Currace is an Indipident company and provides accouning, bookkeeping or business management service at cheapest and don’t have any direct or indirect relationship with Quickbooks official website.