How to Setup, Edit, and Cancel the Direct Deposit in QuickBooks Payroll?

Direct deposit payroll in QuickBooks Payroll is one of the best features in QuickBooks. After you apply Direct Deposit to QuickBooks for your organization in QuickBooks Desktop Payroll, you can install, change, and change Direct Store Administration for your employees.

Employees who require direct stores should fill out the direct deposit authorization structure and give you zero checks from their financial balance. The approval structure and zero checks are just for your records, you do not need to submit them to QuickBooks.

Direct deposit is a programmed electronic exchange that allows frequent booked installments, salaries, tax refunds. It is an electronic system that gives banks the opportunity to package various exchanges together and process them in batches, which is possible through an automated clearing house (ACH).

Direct deposits provide a useful, secure, and reliable option, unlike traditional paper checks, although not mistaken for direct installment using ACH credit or commonly used to purchase or pay bills on the web.

Table of Contents

Important Point that you Consider before Cancel the Direct Deposit

- On the off chance that the immediate store is closed for the ACH process, it cannot be fixed by Intuit.

The cancellation process should be done before 5:00 pm. Clear time and 2 banking days before the paycheck date. - When the immediate (Direct Deposit) store has submitted for ACH handling, Intuit cannot stop or prevent the Direct Deposit from presenting your worker’s financial balance.

- Direct store ACH handling entries occur at exactly 5 o’clock, two financial days before the check date.

- You should submit any paycheck void or stop the demand before 5 pm. two financial days before the paycheck date.

How to Set up an employee for direct deposit in quickbooks:

- Firstly, to open your employee list choose the Employees and the Employee center. Click double on the employee’s name.

- Select the Payroll Info tab and direct deposit button.

- From the Direct Deposit window, Select and use the Direct Deposit for the employee’s name.

- Choose whether to store the check-in one or two records.

- Enter the representative’s monetary base data (bank name, routing number, account number and account type).

- On the off chance if you kept two occasions, enter the amount or rate that the representative needs to be stored in the primary record in the deposited amount. The rest of the later records.

- Select OK to clear the data.

- Enter your Instant Store PIN when prompted.

The following checks you make for the representative will be set aside directly for the store. In the event that you need to store it directly on a check that you have not yet sent, you should erase the check and reproduce it. In the event that an inappropriate direct record has not been yet sent to a check, you can search for the check directly in the check and open the check, clearing the checkmark with the check direct deposit, including the check Mark’s return is also included. Direct deposit amount. Verify the correct instant store data and discard the check. Intuit cannot add direct deposit administration to a check that has just been sent.

Steps to Cancel the Direct Deposit In quickbooks Payroll

- Follow these simple advances and leave an immediate store on quickbooks Payroll

- Select Edit/void Paychecks of employees on the top menu.

- On the edit page, show the check through the date of the check and press tab on the console.

- Click void to check the problem.

- In the pop-up box, enter yes and click void.

- Now you click on the Check Terms and Conditions box.

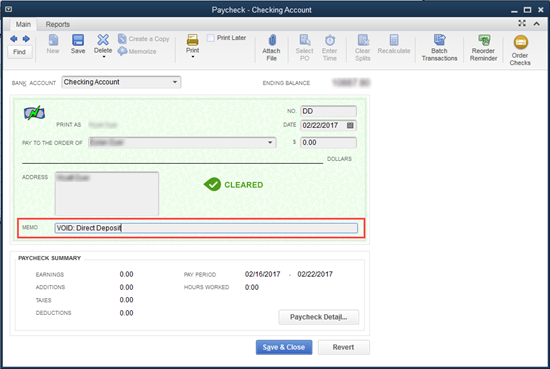

- When the checks have become voided, close the Change / Zero check window. After the check is void paychecks.

- Click on the employee above the bar and send finance information.

- Click send at that point, yet you will not find a shop to send.

- Checks are voided by looking at your bank register used to pay workers. The update line will indicate that the test has changed.

How to Check the financial condition in quickbooks Payroll

- Firstly visit the top menu bar, Select Employee> My Payroll Service> Account or Billing Information.

- After that using your id and password login into quickbooks Intuit Account.

- Choose the View payroll activity in the Direct Deposit part.

- Enter the Direct Deposit PIN.

- And Look for payroll circulation with checks that need to be stopped.