How to Setup Job Costing in quickbooks Online?

Hi, user to know about job costing in quickbooks online, you are at the best place, here we put our 100% effort to describe what is job costing and how to set up in a quickbooks online and how it is beneficial for quickbooks users or accountants. To set up job costing in QBO if you don’t want to read a complete post or article and don’t have enough time to read every aspect or point then you can call on +1-888-671-7238 number and talk with quickbooks ProAdvisor.

Job costing is tracking all the expenses for a job and comparing those expenses to revenue. The cost of working on quickbooks Online provides many jobs costing tools, which helps to analyze how much money you spend on each job and the cost of a job for a client or employment. quickbooks user does not need to buy an extra or some outside programs. So you have to come to our websites and get knowledge about job costing

Job Costing helps to track all expenses and also compares these expenses to your profits. Job Costing is available when you are earning less and not making profits, so it is particular employment or cost for the customers and enables you to benefit from the activity. The cost of the job does not require any additional procurement of external programming. To know how to set up and manage job costing in quickbooks online read the complete post, here we discussed how to set up and manage and benefits.

Table of Contents

Benefits of quickbooks Job Costing

Now we can explain that some profits and benefits of job costing in quickbooks online you can read our article and choose the best job costing for growing your business. some benefits are the following are:

- Firstly you can easily check the project-based profitability.

- Improved your estimating.

- You can check which type of job is best suited for your business.

- Also, compare the budget cost to real job costs.

- It provides full cost control over the job.

- Calculate the performance of teams or individuals.

Steps for Performing the Job Costing in quickbooks

Here, several numbers of steps explain by our experts, you can try all the steps when creating a problem for choosing the jobs for growing your business. these are six steps gives in our blog you can resolve your problem also.

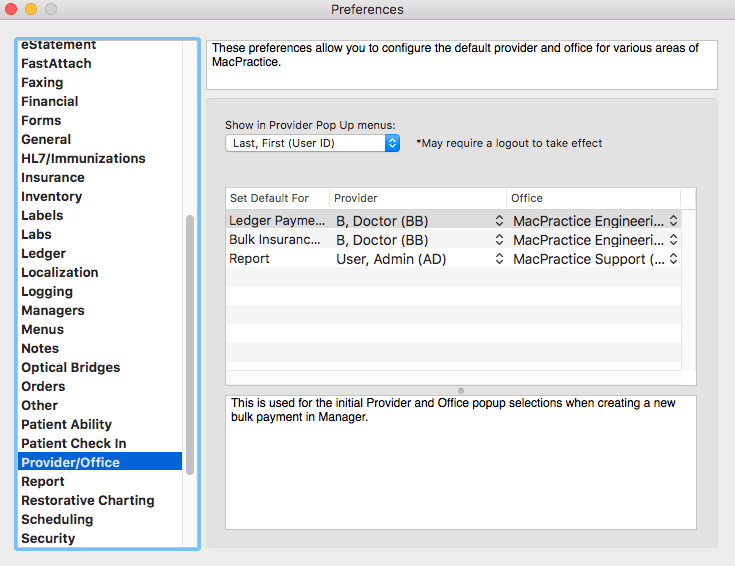

Step 1: Initial Preference configuration for quickbooks online

This is the most important step to certain the quickbooks is properly configured to accomplish this configuration. The points are:

- You have to choose the Edit option and next go to Preference.

- Now, you select the Job & Estimates option and then select the company preferences.

- Under the company preference option, you must take the appropriate modification before initializing job creation.

- You need to verify the time and expenses on the left side of the menu to a certain that time tracking is active when you intend the tracking on the job.

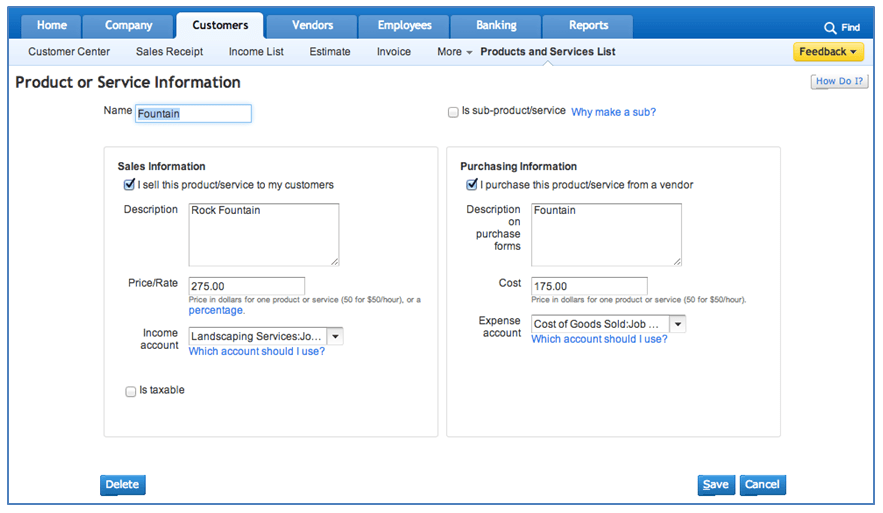

Step 2: QuickBooks Construction Costing

It is the second step that constructs the job for the quickbooks online the points is following are:

- Firstly you choose the list and then click on the customer’s and vendor’s profile.

- Now click the job type list.

- Now you will see the small window for the job type list with the option at the bottom left side.

- Next, you have to click the job type and select the new option.

- Then you will see a new window here is your new job type. Now fill in the information related to the job type here.

- Repeat these steps for the several job types then makes the subtypes for each category. And you can do this by selecting the new again option the put the subtype name.

Step 3: Setup the Jobs for Customers

In these steps, we can explain the points for setting up the job for the customers. And the customer’s jobs exist as an individual entry for which you can assign the task for the customers that points are following are:

- Firstly right-click on the client option and then add the job option.

- Then the next job window has appeared then put the client details and select the job information tab and type the job name in the job field.

- Now select the theme option like Tax.

- Next, you select the status under the job status dropdown then the choice is none, pending or loading or no awarded.

- Enters the necessary field like start date, job description, projected end, and end date.

- Then select the appropriate job.

- When you fill in all the details the click on the OK button.

Now you can use these details for the transaction and the reports you make sure all the details are filled correctly.

Step 4: Producing the Bills

Now firstly you create the Invoices for growing your business the points on how to produce the bills are following:

- Create the invoices for the entire Estimate.

- Create the invoices for % age of the full estimate, now type the percentage here.

- Then makes the invoices for the selected items or the different percentage of every item.

If you filled in all the details for creating the invoices then click on the ok button now you have the invoices-based selection.

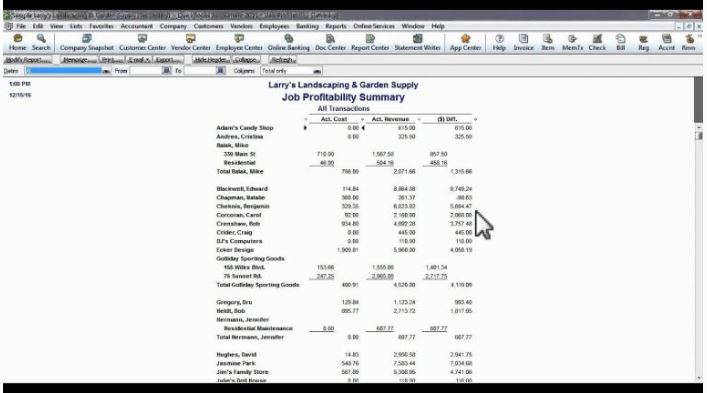

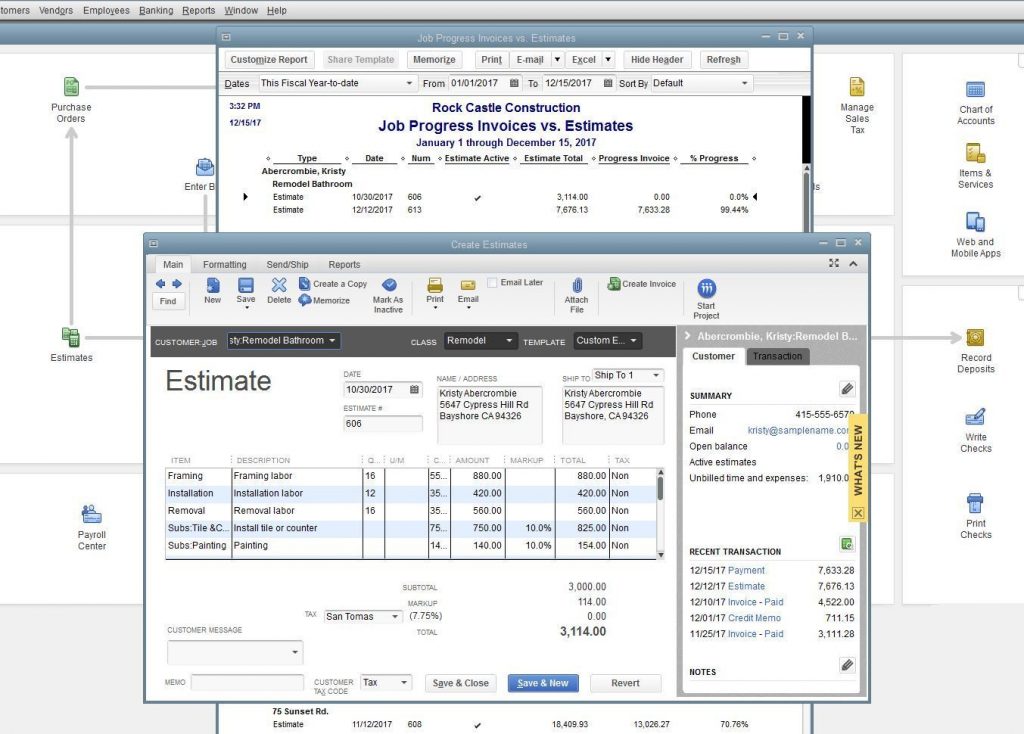

Step 5: Advanced Reporting for Jobs

Now in these steps, we define how to get reports for the jobs the reports are an essential aspect for proper analysis and the job costing field is no different here. The quickbooks jobs costing is produced advanced reports so that you can task performers such as check estimate accuracy, time and mileage, productivity, and also job status for growing and manage our business.

Step 6: Used the Progress Invoices and Estimate

Your company used the estimate and modified order regularly and adequately you can easily use the reports to recognizes your issues such as missing change orders. You can use quickbooks for generating the invoices from the estimating depending on the percentage of full-estimate using that also manages the business.